Through our marketing research we support entrepreneurs in making the right decisions in all areas of marketing management. We measure, verify, check, analyse and provide valuable recommendations.

We carry out research in 4 main areas: market and customers, new products, prices and distribution, brand and advertising.

We apply a variety of research techniques to understand consumer and business behaviour and attitudes.

Research areas

Market and customers

Expand the list

Collapse the list

Ask for offer

| Research into market size and capacity | We determine the number of buyers and the volume and value of product sales. |

| Market functioning and competition research | We research how the market is developing. We identify trends and activities of competitors. |

| Research into the opportunities and threats of entering a new market | We acquire information that allows us to develop an effective strategy for entering new markets. |

| Research into consumer needs and preferences | We help to understand customer needs and expectations. |

| Customer satisfaction, loyalty and CX research | We measure customer satisfaction. We monitor loyalty and factors affecting it. We determine the value of the NPS indicator. |

| Segmentation research | We identify segments, learn about their behaviour, help select target groups and strategy. |

| U&A behaviour and attitude research | We describe how customers buy and use products, and what their attitudes are towards them. |

| Shopper research | We get to know shoppers better by talking to them near the shop shelf. |

| Reach area research | We identify where customers come from to retail and service establishments. |

| B2B customer research | We study business behaviour and B2B customer satisfaction. |

New products

Expand the list

Collapse the list

Ask for offer

| Concept tests | We identify consumer opinions on the concept of new products and services. We determine which elements of the concept are acceptable, and which should be changed. |

| Product tests | We determine how the target group assesses individual product characteristics, including sensory characteristics. We optimise products using conjoint analysis. |

| Packaging tests | We determine consumer attitudes to different packaging and help you choose the best. |

| Price elasticity tests | We help you determine the right price for your products, using Van Westendorp's PSM analysis, the Gabor-Granger model or Brand-Price Trade-Off. |

Prices and distribution

Expand the list

Collapse the list

Ask for offer

| Price Research | We analyse retail product prices and monitor trading conditions in B2B research. |

| Distribution Research | We monitor product availability and distribution rates. |

| Mysterious Customer | We review customer service standards. |

Branding and Advertising

Expand the list

Collapse the list

Ask for offer

| Research into brand awareness and brand image | We identify brand awareness and consumer perception and analyse brand equity. |

| Brand tracking research | We monitor changes in the level of brand awareness and brand image over time and assess the effectiveness of marketing activities. |

| Pre-testing of advertisements | We test various versions of creations in order to improve advertisement effectiveness. |

| Claims and slogan tests | We help you choose an advertising slogan that best appeals to customers and stands out against the competition. |

| Advertising campaign effectiveness tests | We determine the reach and impact of campaigns on brand awareness and image, and the purchasing behaviour of the target group. |

Research methods

In research projects we combine various techniques to effectively solve decision-making problems.

Quantitative research

Expand the list

Collapse the list

- CAWI - computer-assisted web interview

- CATI – computer-assisted telephone interviewing

- CAPI – computer-assisted personal interviewing

- HUT – home use tests

- CLT – central location tests

- MS – mystery shopping)

Qualitative research

Expand the list

Collapse the list

- IDI – individual in-depth interview

- FGI – focus group interview

- MROC – market research online community

- Experts – interviews with industry experts, foresight / brainstorming research

Other

Expand the list

Collapse the list

- Eyetracking – visual perception research using the Tobii eye tracker

- Desk research – secondary data analysis

Specialisations

We carry out research projects for Customers from almost all industries, however, we have the greatest experience in the following areas:

FMCG

Show

Hide

Research into consumer buying behaviour, satisfaction and loyalty monitoring. Insight seeking and advertising research. Product and packaging tests.

Optics

Show

Hide

Periodic research into the optical industry OPTYKBUS. Market analysis of lenses, glasses frames and contact lenses.

Sport

Show

Hide

Research into the sporting activities of Poles and their preferences and buying behaviour concerning sports equipment and clothing.

Construction

Show

Hide

Research of the construction market upon individual order (ad hoc) and regular syndicate research OMNIBUD.

Interior design

Show

Hide

Research into consumer behaviour and preferences and expectations regarding interior design. Research into attitudes and recommendations of interior design brands.

Clothing and footwear

Show

Hide

Research into preferences and purchasing behaviour of customers of clothing and footwear chain shops.

Shopping centres

Show

Hide

Research of satisfaction and expectations of shopping centre customers. Research on tenants' satisfaction and needs. Research into marketing communication effectiveness.

Industry

Show

Hide

Expert (ad hoc) research of various industries. Analysis of the competitive environment, industry situation, market capacity.

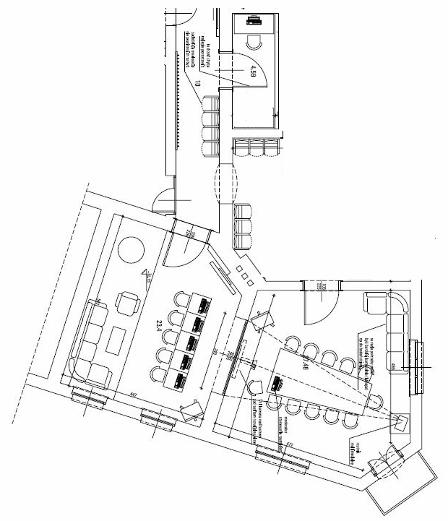

Qualitative research studio

We have our own, modernly equipped studio for qualitative research, located in Katowice. Its space has been arranged in such a way as to ensure maximum comfort and freedom of work for moderators, respondents and people analysing the research.

Almost 60 m2 of space

Show

Hide

- Focus room - 27 m2

- Preview room - 23 m2

- Interpreter's room 4 m2

- Kitchen facilities

Focus room

Show

Hide

- 10-seat table

- Large TV, screen and multimedia projector

- Controlled overhead and side lighting

- Sound system controlled from the moderator's desk

- Internet

- Air conditioning

- Internet transmission of discussions (video-streaming)

Preview room

Show

Hide

- 4 workstations

- Large Venetian mirror (220×115 mm)

- Internet

- TV LCD 37’’

- Air conditioning

- Audio track control function (original, with interpretation)

Interpreter's room

Show

Hide

- Independent room for simultaneous interpretation (in real time)

- Possibility to choose the soundtrack in the preview room

- Recording of original and interpreted soundtracks

- Internet transmission of discussions (video-streaming)